Active Shooter Insurance Coverage: Protecting Businesses from the Unthinkable

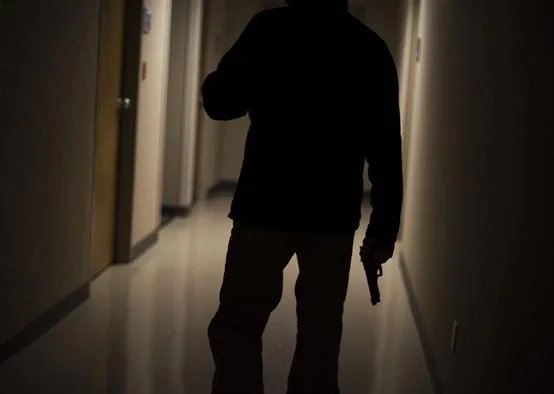

The recent tragedy in New York has once again brought national attention to the growing threat of active shooter incidents in public and commercial spaces. From bustling cafés to corporate offices, no business is immune to the possibility of such an event.

While security measures and staff training are vital, there’s another layer of protection many business owners overlook: Active Shooter Insurance Coverage.

This specialized form of commercial insurance helps businesses recover financially, operationally, and reputationally after an incident ensuring that employees, customers, and owners have the resources they need in the aftermath.

What is Active Shooter Insurance Coverage?

Active Shooter Insurance Coverage is designed to provide both liability protection and financial support in the event of an active shooter or other violent attack on your premises.

Policies typically include:

Liability protection if your business is sued following an incident

Medical expense coverage for victims, including employees and customers

Business interruption coverage to replace lost income during closure

Property damage coverage for repairs and restoration

Crisis response services, including counseling and public relations support

Why Every Commercial Space Should Consider It

Restaurants, retail stores, hotels, entertainment venues, and office buildings are all potential targets due to high foot traffic and public access. Even with strong safety protocols, the financial and legal consequences of an incident can be devastating.

Key reasons to secure coverage:

Financial resilience: Covers unexpected expenses so your business can survive

Legal protection: Shields against lawsuits that can follow an incident

Reputation management: Access to crisis communication and PR support

Employee support: Counseling and assistance programs for affected staff

If you operate in a high-traffic industry, our business insurance solutions can be tailored to your specific needs.

Active Shooter Insurance for Specific Industries

While any business with a physical location can benefit, certain industries face higher risks:

Restaurants & Cafés: High customer turnover and open access make these spaces vulnerable.

Retail Stores: Large crowds increase the challenge of prevention and evacuation.

Hotels & Event Venues: Security must balance openness with guest safety.

Corporate Offices: Workplace violence incidents are on the rise nationwide.

We also offer specialized coverage for niche sectors such as cannabis insurance, where security and liability considerations are unique.

The Business Case for Coverage

Without proper coverage, businesses may face hundreds of thousands, if not millions, in costs after an incident. From lawsuits and victim compensation to rebuilding and lost income, the financial burden can be overwhelming.

Active Shooter Insurance offers a safeguard that ensures your business can recover and continue operating after tragedy.

Conclusion

No insurance policy can undo the harm of a violent act, but the right coverage can give your business and the people who depend on it, a fighting chance to recover.

At Starisks Insurance, we specialize in helping business owners secure comprehensive protection against today’s evolving risks.

📞 Contact us today to discuss Active Shooter Insurance Coverage tailored to your business needs.